20 Recommended Reasons To Choosing AI Stock Picker Platform Websites

20 Recommended Reasons To Choosing AI Stock Picker Platform Websites

Blog Article

Top 10 Tips On Assessing The Cost And Cost Of Ai Platform For Predicting And Analyzing Stocks

It is crucial to evaluate the cost and pricing of AI trading platforms that forecast or analyze price of stocks. This will allow you to keep out any costs that are not obvious. Knowing what you pay for and the pricing structure can be very different. This will allow you to make an informed choice. Here are the top 10 suggestions to evaluate the cost and pricing of these platforms:

1. Understanding the Pricing Model

Subscription-based: Check if the platform charges monthly or annually and what features each tier includes.

Pay-per-use: Make sure the charges for the platform are based on usage, for example, the number of trades (or request for data), or prediction.

Freemium model: Assess whether the platform provides an unpaid tier that has limitations on features and fees for premium features.

2. Compare Pricing Tiers

Compare features across each pricing level (e.g. basic, professional).

Scalability. Make sure you have the appropriate pricing to meet your requirements.

Upgrade flexibility: Find out whether it's possible to upgrade or downgrade your plan as you change your needs.

3. Evaluate Hidden Costs

Data charges: Find out if you are required to pay for access to premium data.

Brokerage charges - Check for any additional fees are charged by the platform for execution of trades, or integration with brokers.

API usage - Assess whether there are any additional costs that come with API access or high-frequency use.

4. Demos, Free Trials and Test Drives

Trial period: Search for websites that provide a free trial or demo of their capabilities before you commit to.

Limitations of the trial: Make sure that it is inclusive of all features or if there are limitations on the functionality.

Alternatives with no commitments You should be able to cancel your trial without incurring costs if you discover that the software does not meet your requirements.

5. Look for discounts and promotions.

Annual discounts: Determine whether your platform offers discounts on subscriptions paid annually compared with plans billed monthly.

Referral programs: Find out if the platform provides discounts or credit for referring other users.

Institutional pricing If you're part of a larger organization, inquire about bulk or institutional pricing.

6. Examine Return on Investment (ROI)

Cost vs. Value: Find out if the functions and projections of the platform justify the cost. Does it help you save time or aid in making better choices in trading?

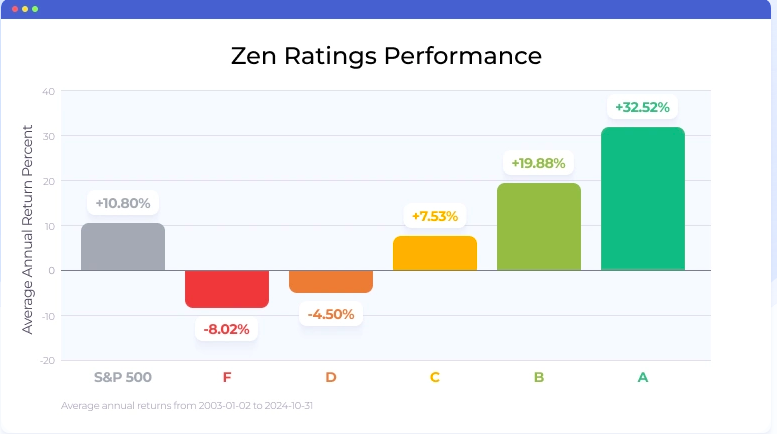

Performance track record: Research the platform's performance rate or testimonials from users to determine its potential ROI.

Alternative costs: Comparing the cost of the platform to the costs that could be incurred if it is not used (e.g. lost opportunities, manual data analysis time).

Review the Policies for Cancellation/Refund and Review

Cancellation Terms: You may cancel your contract without any hidden fees or penalties.

Refund policy: Find out what the policy is for refunds. the amount you paid for.

Auto-renewal (automatic renewal) Learn whether you need to renew your subscription automatically. Find out how you can opt-out.

8. Pricing should be transparent

Price page that is clearly written Make sure that the platform has a detailed and up-to-date pricing page with no hidden charges.

Customer Support: To clarify unclear pricing information and other costs, contact customer service.

Terms of service: Read the conditions of service to know any long-term commitments or penalties.

9. Compare with Competitors

Comparing the features and prices of different platforms against their rivals will allow you to get the most value.

User reviews: Read user feedback and see whether other users agree that this platform is worth it.

Market positioning: Look at the prices and determine if you are getting a platform that is compatible with your needs.

10. Examine the Long-Term Costs

Price hikes: Check out the past history of the platform and observe how often it has raised prices.

Additions to features - Check if new features are included in your current plan or if an upgrade is necessary.

Costs of Scalability: Ensure that the pricing of your platform is reasonable as your trading activity or needs for data grow.

Bonus Tips

Test different platforms. Examine the capabilities and benefits of different platforms by evaluating them during free trials.

Negotiate the price: If are frequent users or member of a large company, ask about special pricing or discounts.

There are many platforms offering educational resources and tools free.

These guidelines will allow you to determine the cost and price of AI trading platforms that predict/analyze the prices of stocks. In this way, you'll be able to select the one that best matches your budget and offers the features and performance you need. A balanced platform will offer you the most efficient of both in terms of affordability and functional. Check out the top rated straight from the source about ai for investment for website tips including ai investment platform, best ai trading app, using ai to trade stocks, ai stocks, investment ai, chart ai trading assistant, ai investment platform, ai trade, using ai to trade stocks, ai trade and more.

Top 10 Tips On Assessing The Feasibility And Trial Of Ai Analysis And Stock Prediction Platforms

In order to ensure that AI-driven stock trading and forecasting platforms meet your expectations It is important to evaluate the trial options and flexibility prior to committing to a long-term contract. Here are the top ten tips to consider these elements.

1. Try it for Free

Tips: Make sure that the platform you're looking at provides a free trial of 30 days to evaluate the capabilities and features.

The platform can be evaluated for free.

2. Limitations on the Time and Duration of Trials

Tip - Check the validity and duration of the free trial (e.g. limitations on features or data access).

The reason: Once you understand the trial constraints and limitations, you can decide if it's a complete evaluation.

3. No-Credit-Card Trials

You can find trial trials for free by searching for ones that do not ask you to provide the details of your credit card.

The reason: This can reduce the chance of unexpected charges and will make it easier for you to cancel your subscription.

4. Flexible Subscription Plans

Tip. Look to see whether a platform has the option of a flexible subscription (e.g. annual or quarterly, monthly).

Why: Flexible plans allow you to choose the level of commitment that's best suited to your budget and requirements.

5. Customizable Features

Find out if the platform provides customization options, such as alerts and levels of risk.

The reason: Customization allows the platform to your trading goals.

6. The Process of Cancellation

Tip: Find out how easy it is to downgrade or cancel your subscription.

What's the reason? If you can cancel without any hassle, you can stay out of the wrong plan for you.

7. Money-Back Guarantee

Tip - Look for websites that provide the guarantee of a money-back guarantee within a specific time.

Why: This will provide an additional layer of protection should the platform fail to meet your expectations.

8. All features are available during trial

Check that you can access all the features in the trial, and not just a limited edition.

What's the reason? You can make an the right choice based on your experience by testing all of the features.

9. Customer Support during Trial

TIP: Examine the quality of support available throughout the trial time.

You can get the most out of your trial experience by utilizing the most reliable assistance.

10. Post-Trial Feedback System

Make sure to check the feedback received during the trial in order to improve the quality of service.

Why: A platform with the highest level of user satisfaction is more likely than not to evolve.

Bonus Tip: Scalability Options

Make sure the platform is scalable to meet your requirements, providing higher-tier plans or additional features as your trading activity grows.

If you take your time evaluating these trial and flexibility options, you can decide for yourself whether an AI stock prediction and trading platform is a good option for you prior to making an investment. Follow the most popular ai share trading for blog info including ai tools for trading, chart analysis ai, best ai stocks to buy now, ai in stock market, can ai predict stock market, ai software stocks, ai share trading, ai software stocks, best ai trading platform, ai options trading and more.